Amur Capital Management Corporation Can Be Fun For Anyone

Amur Capital Management Corporation Can Be Fun For Anyone

Blog Article

Unknown Facts About Amur Capital Management Corporation

Table of ContentsThe Of Amur Capital Management CorporationThe Ultimate Guide To Amur Capital Management CorporationThe 4-Minute Rule for Amur Capital Management CorporationUnknown Facts About Amur Capital Management CorporationThe Best Guide To Amur Capital Management CorporationA Biased View of Amur Capital Management CorporationThe Ultimate Guide To Amur Capital Management Corporation

worth recognition Lendings are practical, however they might come at a big cost. You dedicate your future earnings to obtain energy today at the expense of passion spread throughout several years. Be certain you recognize just how to take care of lendings of this nature and prevent high degrees of financial debt or what they call over-leverage.

The Single Strategy To Use For Amur Capital Management Corporation

Dangers consist of hold-ups, boosted prices, and the unknowns of a newly-developed neighborhood. Existing properties provide convenience, faster gain access to, developed renovations (utilities, landscaping, and so on), and in several cases, lower costs.

, recent surveys, and appraisal reports for existing buildings. Think about month-to-month maintenance costs, exceptional fees, and tax obligations. Prices such as these can seriously impact your cash money circulation.

Top Guidelines Of Amur Capital Management Corporation

If essential, deal with enhancing your credit report score: Pay costs on timeset up automated payments or remindersPay down debtAim for no greater than 30% credit report utilizationDon't shut extra credit score cardsas long as you're not paying annual feesLimit demands for brand-new credit rating and "difficult" inquiriesReview your credit rating record and disagreement mistakes Just like various other sorts of investments, it's excellent to buy low and sell high.

The 5-Minute Rule for Amur Capital Management Corporation

It's likewise crucial to take notice of home mortgage prices so you can reduce your financing costs, if possible. Stay current with fads and stats for: Home costs and home sales (overall and in your wanted market)Brand-new constructionProperty inventoryMortgage ratesFlipping activityForeclosures Genuine estate can aid expand your profile. Generally, realty has a reduced relationship with other significant property classesso when stocks are down, realty is commonly up.

Naturally, similar to any kind of financial investment, it is necessary to think about certain aspects, like the ones noted here, prior to you buy genuine estatewhether you go with physical residential property, REITs, or something else. (https://sandbox.zenodo.org/records/56679)

We have a sneaking uncertainty you currently recognize what investing is, yet simply in situation, let's specify spending terms. Spending involves committing cash in order to gain a monetary return.

Amur Capital Management Corporation Things To Know Before You Buy

Regardless of where you spend your cash, you're essentially providing your cash to a company, federal government, or various other entity in the hope they offer you with even more money in the future. Usually investing is connected with placing money away for a lengthy period of time rather than trading stocks on a more routine basis.

Financial savings are occasionally guaranteed yet investments are not. If you were to keep your money under the bed mattress and not invest you would certainly never ever have even more cash than what you have actually put away on your own. That's why many individuals choose to invest their cash. There are many things you can place cash into.

Everything about Amur Capital Management Corporation

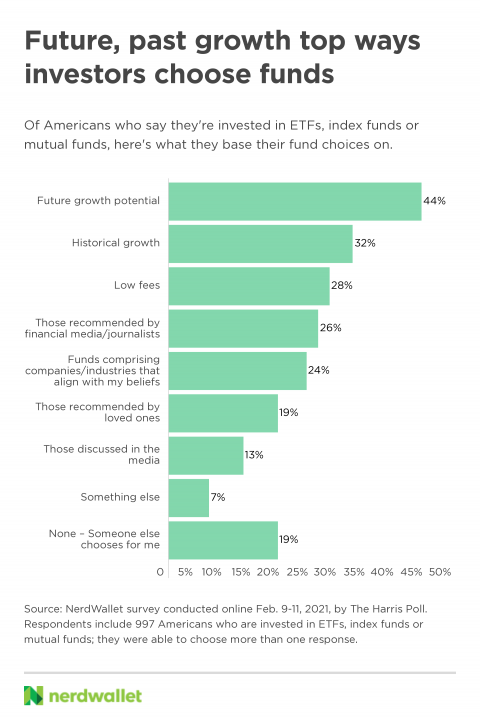

StocksBondsETFsMutual fundsCash equivalentsReal estateREITsCommoditiesNow we understand you're eager to discover the investing fundamentals considered that you're reading this post. Let's hold for a 2nd and number out if you must be investing in the very first area (https://hubpages.com/@amurcapitalmc). First things initially. Prior to you start purchasing anything, you should ask on your own a pair important inquiries.

Discharges, all-natural disasters, sicknesses let us count the means in which your life can be turned upside down. Any monetary consultant will certainly tell you that to avoid overall spoil you should have between six months and a year of overall living costs in money, or in a interest-bearing account ought to the unthinkable occur.

The Best Strategy To Use For Amur Capital Management Corporation

Prior to we discuss the specifics of what you ought to think about buying, be it supplies, bonds, or your cousin Brian's yak ranch allowed's initially discuss the fundamentals of how one spends. Investing is what takes place when at the end of the month, after the costs are paid, you've got a couple of bucks left over to put towards your future.

How are you intended to find those elusive added dollars to conserve? Right here's just how. In all likelihood, you'll gain much more in your thirties than you performed in your twenties, and much more than that in your forties. The vital to saving is to do your outright finest to avoid what's called "way of living creep." If you haven't come across this before, let us clarify.

Report this page